Compliance you can measure.Oversight you can defend.

With Lexalign, depository institutions can recruit their customers at scale into compliance and risk management, for fraud prevention, demonstrable oversight and confident growth.

ON DEMAND

Office Hours for Banks: Nacha Fraud Monitoring Rules

A practical Q&A on what the New Rules mean—and how banks are operationalizing them.

ON DEMAND WEBINAR

4 Boxes to Check for Nacha's 2026 Fraud Monitoring Rules

Learn the full scope of what the Rules require and the toolkit you'll need.

FREE GUIDE

Download the Guide: 4 Boxes to Check for Nacha's 2026 Fraud Monitoring Rules

Fraudsters exploit the least secure channel:

your customers.

Fraudsters are exploiting gaps in your customers’ operations and sophistication that are invisible to you.

$486B

in reported financial crime losses in 2023, according to Nasdaq.

79%

of US organizations report being targets of payments fraud 2024, up from 65% in 2022.

Cost of fraud is compounded when participants in the payment system aren't compliant.

Banks rely on 10s of millions of SMB clients to ensure that 10s of trillions of dollars in digital payments and deposits are properly authorized, compliant and secure.

Banks use Lexalign's automated solutions to manage risk and compliance at scale.

Lexalign delivers a risk management platform to customers and advance warning to banks, enabling you to move from reactive, laborious and costly defense to proactive, efficient, data-based routines.

Fraud Prevention

True Compliance

No Integration Needed

Data-powered Risk Management

Audit-ready Records

Easy Set-up in Hours

HowLexalignWorks

3 Easy Steps

STEP 1

Conduct a Compliance Audit

On a dedicated “Compliance Dashboard,” Lexalign takes each of your customers through the fundamental step in risk management: a self-assessment of their operations against the rules and risk framework to determine what rules apply and where they deviate. No background expertise required.

STEP 2

Deliver a Risk Compliance Program

Next, Lexalign instantly furnishes your customers with critical information they need to manage their risk and compliance: an Audit Report (with an inventory of regulated activities, a gap analysis and an action plan); a customized Policy, Procedures and Training packet; a dynamic Remediation Checklist.

STEP 3

Receive Actionable Compliance Records

You instantly get essential records that demonstrate your risk management at scale, as well as scoring and analysis that enable proactive, low-effort, targeted interventions to mitigate risk and strengthen your customer relationship.

Banks that use Lexalign have realized...

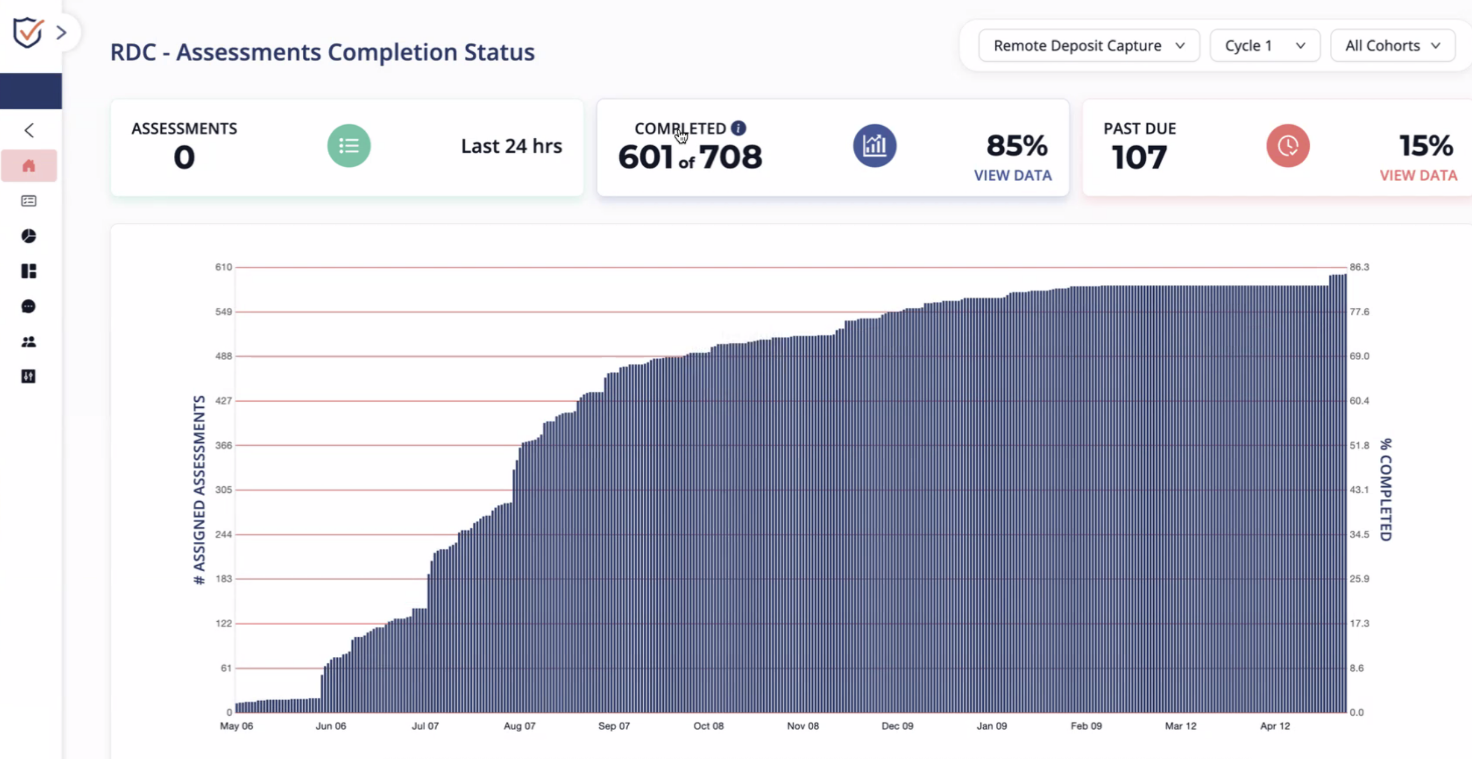

80%

of customers complete their assigned assessment.

95%

of customers open their audit reports

100%

Resolution of related audit exceptions and findings

Plus, banks achieve higher customer engagement, retention, deposits, and sales, as well as growth with demonstrable compliance even beyond their footprint.

Transform Fraud Prevention: Why This Matters

Fraud that targets customers as the access point is fast becoming the next crisis in banking. According to the latest AFP Payments, Fraud and Control Survey Report, 4 out of 5 customers report being attacked, and fraud is rising over all payment channels, including ACH checks and wires.

To fraudsters, the customer is now the front door of the bank, and according to Nacha, credit-push fraud has become the predominant form. Nacha has called for a New Risk-Management Framework For Credit-Push Fraud, one in which “all participants in the payment system, whether the ACH Network or elsewhere, have roles to play in working together to combat fraud.” All participants necessarily includes the non-consumer customer as the starting point.

But it is not feasible to effectively assess and empower the security and compliance of customer operations at scale using legacy manual approaches. We created Lexalign to solve this systemic gap.

“LexAlign reduced our staff need by 75% and resolved an audit concern.”

– Southern Bank

Case Study:Southern Bank & LexAlign

Learn how LexAlign helped Southern Bank fuel their growth by streamlining compliance and vastly increasing operational efficiency

Compliance Automation

Risk Management

Operational Efficiency

Customer Engagement

News & Resources

February 3, 2026

From Guidance to Enforcement: The Real Consequences of Not Preparing for Nacha’s Fraud Monitoring Rules

No bank wants to spend money on a new solution—especially in an environment where budgets…

0 Comments10 Minutes

January 9, 2026

The “4 Boxes” to Check for Audit-Ready Compliance

As financial institutions enter 2026, one topic continues to surface in payments, risk,…

0 Comments13 Minutes

CONTACT US

Get Started Today

Join leading financial institutions in transforming your risk management approach. Discover how Lexalign can help you achieve compliance excellence and protect your organization from fraud.